Credit card rewards have become an essential tool for savvy consumers looking to maximize their spending power and enhance their travel experiences. Whether you're a seasoned points enthusiast or just starting to explore the world of credit card rewards, understanding how to effectively use and track these benefits can lead to significant savings and unforgettable adventures. In this article, we'll dive into ten expert tips that will help you make the most of your credit card rewards, ensuring you're not leaving any value on the table.

Understanding Credit Card Rewards

Before we jump into our expert tips, it's crucial to understand the basics of credit card rewards. These rewards typically come in three forms: cash back, points, and miles. Cash back offers a straightforward return on your spending, usually as a percentage of your purchases. Points and miles, on the other hand, can be redeemed for travel, merchandise, gift cards, or even converted to cash back in some cases.

The key to maximizing these rewards lies in strategic planning and consistent tracking. By implementing a well-thought-out credit card rewards strategy, you can transform your everyday spending into valuable perks and savings. Let's explore how you can do just that with our expert tips.

1. Choose the Right Rewards Card for Your Spending Habits

The foundation of any successful credit card rewards strategy is selecting the right card for your unique spending patterns. To do this effectively, take a deep dive into your monthly expenses. Look at where you spend the most money – is it groceries, dining out, travel, or general purchases?

Once you have a clear picture of your spending habits, research cards that offer bonus rewards in your high-spend categories. For example, if you're a foodie who frequently dines out, a card that offers 5% cash back on dining might be your best bet. On the other hand, if you're a frequent traveler, a card that earns multiple points per dollar on travel expenses could provide more value.Remember, there's no one-size-fits-all solution. The best card for you is the one that aligns with your specific spending habits and lifestyle.

2. Proactively Track Spending and Estimate Future Rewards

To truly maximize your rewards, it's essential to have a clear picture of your spending habits and potential earnings. While each card might have its own interface to track spending and rewards, you will need a unified view of all of your accounts and rewards to get a holistic view of your finances.

One effective method is to use a tool to track your spending across different cards and categories. This allows you to:

- Monitor your progress towards meeting sign-up bonus requirements

- Ensure you're not exceeding category spending limits

- Project future rewards based on your typical spending patterns

- Identify areas where you could potentially earn more rewards

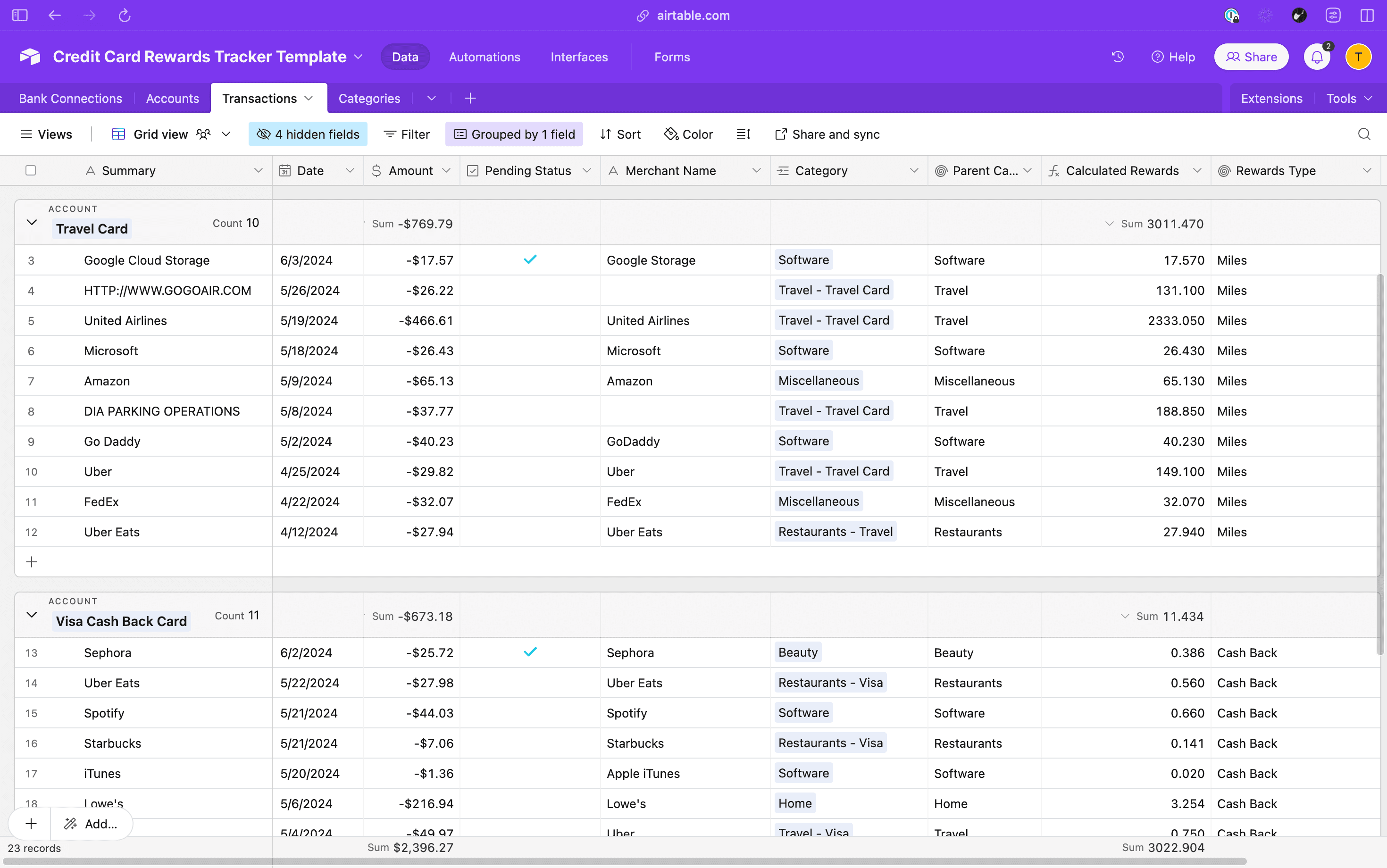

Check out this Airtable template to track your credit card rewards:

By regularly updating and reviewing this information, you can make data-driven decisions about your credit card usage and rewards strategy.

3. Maximize Sign-Up Bonuses

One of the quickest ways to accumulate a large number of rewards is through sign-up bonuses. These welcome offers can provide a substantial boost to your rewards balance, often worth hundreds of dollars in travel or cash back.

To make the most of these bonuses:

- Research current offers before applying for a new card

- Look for cards with large bonuses and manageable spending requirements

- Time your applications to coincide with large planned purchases to help meet spending thresholds

4. Leverage Category Bonuses

Many rewards cards offer bonus points or cash back in specific spending categories. These can rotate quarterly or remain fixed throughout the year. By strategically using cards that offer higher rewards in certain categories, you can significantly boost your earnings.

For example, some cards offer 6% cash back at U.S. supermarkets (up to a certain spending limit per year). Others might offer 5% cash back on rotating categories like gas stations, streaming services, or home improvement stores.To maximize these bonuses:

- Keep track of your cards' bonus categories

- Use the appropriate card for each purchase to earn the highest possible rewards

- For cards with rotating categories, set reminders to activate the bonuses each quarter

5. Combine Multiple Cards for Optimal Earnings

While it might seem simpler to use just one rewards card, combining multiple cards can significantly increase your overall rewards earnings. This strategy, often called the "card combo" approach, involves using different cards for different types of purchases to maximize rewards across all spending categories.

For instance, you might use:

- A card that earns 4x points on dining and U.S. supermarkets for those expenses

- Another card that earns 3x points on travel and transit for those purchases

- A flat-rate 2% cash back card for all other expenses

By strategically using the right card for each purchase, you ensure you're always earning the highest possible rewards on every dollar spent.

6. Use Shopping Portals and Special Offers

Many credit card issuers provide online shopping portals that offer additional cash back or bonus points on purchases from participating retailers. By simply clicking through these portals before making an online purchase, you can earn extra rewards on top of what your credit card already offers.

For example, the Shop Through Chase portal offers extra cash back incentives on purchases from various online retailers. Similarly, American Express, Capital One, and Citi all have their own versions of these portals.In addition to shopping portals, keep an eye out for special offers and promotions from your card issuer. These might include bonus points for specific purchases or statement credits for shopping at certain retailers. Regularly check your credit card app or online account for these offers and activate them before making eligible purchases.

7. Understand Point Transfer Options

If you have a card that earns transferable points, understanding and utilizing transfer partners can significantly increase the value of your rewards. Many issuers allow you to transfer your points to various airline and hotel loyalty programs, often at a 1:1 ratio.

By transferring points strategically, you can potentially get much more value than if you were to redeem them directly through your credit card's travel portal. For example, transferring points to an airline partner for a business class ticket could yield a value of 3-5 cents per point or more, compared to the typical 1-1.5 cents per point when redeeming through a credit card portal.

To make the most of this:

- Research transfer partners and their award charts

- Look for transfer bonuses, where you can get extra points or miles when transferring

- Consider the flexibility of your points and how they align with your travel goals

8. Redeem Rewards Strategically

Not all redemptions are created equal. To get the most value from your rewards, it's crucial to understand the various redemption options and their relative values.

Generally, redeeming points or miles for travel often provides the best value, especially for premium cabin flights or luxury hotel stays. Cash back redemptions, while straightforward, may not always offer the highest value per point.

When redeeming for travel:

- Compare the cost in points to the cash price to ensure you're getting a good deal

- Look for sweet spots in award charts where you can get outsized value

- Consider using points for upgrades, which can often provide excellent value

Remember, the best redemption is ultimately the one that aligns with your personal goals and preferences. If a cash back redemption helps you save for a big purchase, that might be more valuable to you than a first-class flight.

9. Stay Organized with Digital Tools

With multiple cards and rewards programs, keeping track of everything can quickly become overwhelming. Fortunately, there are numerous digital tools and apps designed to help you manage your credit card rewards effectively.

Some popular options include:

- AwardWallet: Tracks points and miles across multiple loyalty programs

- The Points Guy App: Offers tools for tracking and optimizing point usage

- MaxRewards: Helps you maximize rewards by suggesting which card to use for each purchase

These tools can help you keep track of points balances, expiration dates, and even alert you to new offers or bonuses.

10. Set Redemption Goals

Having a clear goal in mind can help guide your rewards strategy and keep you motivated. Whether it's a dream vacation, a major purchase, or building up an emergency fund, setting specific targets can help you make better decisions about earning and redeeming rewards.

To set effective goals:

- Be specific about what you want to achieve (e.g., "Save enough points for a round-trip business class ticket to Japan")

- Set a timeline for achieving your goal

- Break down larger goals into smaller, manageable milestones

- Regularly review and adjust your goals as needed

By having a clear objective, you're more likely to make strategic decisions about which cards to use, when to apply for new ones, and how to redeem your rewards.

Conclusion

Mastering the art of using and tracking credit card rewards requires a combination of strategic planning, consistent monitoring, and a willingness to learn. By implementing these expert tips, you'll be well on your way to maximizing the value of your credit card rewards and achieving your financial and travel goals.

Remember, the key to success lies in choosing the right cards for your spending habits, staying organized, and being strategic about how you earn and redeem rewards. With practice and patience, you'll soon find yourself unlocking incredible value from your credit card rewards.

For those looking to dive deeper into the world of credit card rewards, consider exploring resources like The Points Guy or Million Mile Secrets for ongoing tips and strategies. Happy earning and redeeming!